Economics teaches us that competition in markets is a good thing. The health care market is a special market, and competition among providers and insurers is closely monitored by the Federal Trade Commission (FTC). In recent years, the FTC has intervened on several occasions to prevent mergers and acquisitions in health care markets that would have reduced competition to a degree deemed harmful to consumers. The theory goes that if, for example, there is only 1 hospital group in town, the hospital will end up charging patients more for its services than if there were many hospitals in town. The empirical evidence tends to confirm this, with less competition among providers leading to higher prices for patients and less competition among insurers leading to higher premiums and lower provider payment rates. Competition matters.

So let us talk about competition in different parts of the dental care sector. The care delivery side is highly fragmented. Dentistry is the last cottage industry in health care composed mostly of small firms and few large firms with any appreciable market share. The most recent data indicate that 88% of dental offices in the United States have 3 or fewer dentists (Health Policy Institute, unpublished data, 2016). This is certainly changing over time, as more and more practices consolidate. But for now, the dental care delivery side for the most part is highly fragmented.

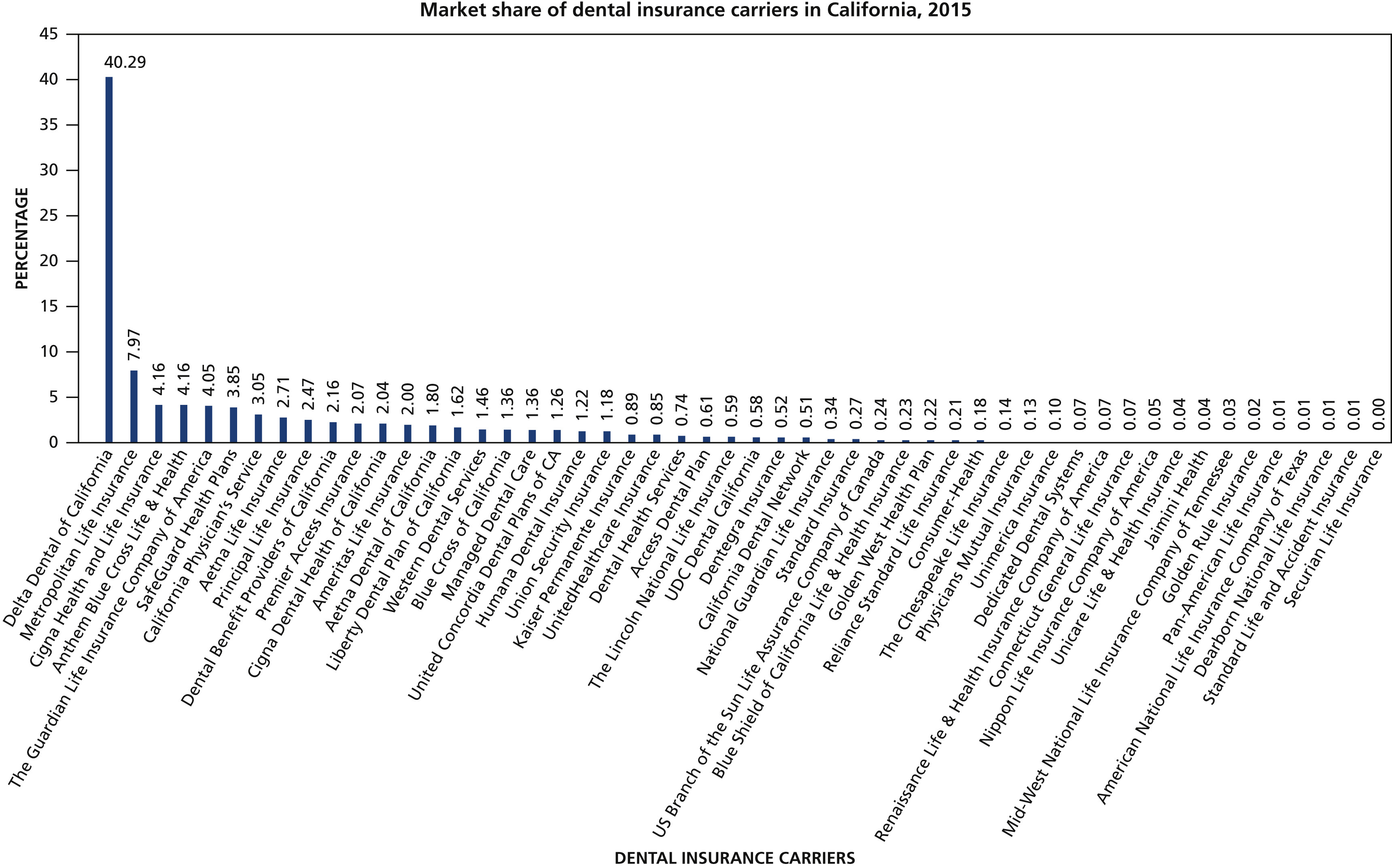

The insurer side, as the figure shows, is a different story. The data summarize the market share of various dental insurance carriers in California. This is the first time ever, as far as we know, that data of this nature were made publicly available. This was a big deal for us because the American Dental Association Health Policy Institute has been trying to obtain dental insurer market data for years, not just for California but for all states. We tried several avenues, including requests to the National Association of Insurance Commissioners and the National Association of Dental Plans. The data we obtained were made available as part of California’s efforts to monitor the medical loss ratio of medical and dental insurance carriers under the Affordable Care Act (ACA).

Figure

The total number of covered lives in California in 2015 was 9,891,539 (as of March 31, 2016). The number of covered lives were aggregated to the insurer level. The market share of covered lives for each insurer was calculated as the number of covered lives by the insurer in 2015 (as of March 31, 2016) divided by the total number of covered lives in California in 2015 (as of March 31, 2016). Source: American Dental Association Health Policy Institute analysis of data from California Department of Managed Health Care6 and California Department of Insurance.7

The data for California show 1 dominant carrier and a long tail of carriers with much smaller market shares. Delta Dental of California has the highest market share (40.3%) and Metropolitan Life Insurance Company has the second highest (8.0%). Furthermore, 31 of 52 insurers have a market share of less than 1%. The Herfindahl-Hirschman Index (HHI) is a fancy way economists measure the competitiveness of markets. Markets in which the HHI is between 1,500 and 2,500 are considered to be moderately concentrated, whereas levels greater than 2,500 are considered to be highly concentrated.8 The HHI for the dental insurance market in California is 1,813.

What are possible implications of a moderately concentrated dental insurance market? Market concentration could result in higher premiums for consumers or lower reimbursement for providers.9 More in-depth research is needed, but our preliminary analysis of newly released premiums data indicates that average premiums for most of Delta Dental of California beneficiaries actually decreased from 2014 through 2016 after adjusting for inflation (Table).6 We do not have access to data for prior years. We also do not have access to data on Delta Dental of California’s reimbursement rates to dentists, but a recent lawsuit settlement suggests reimbursement rates have indeed been declining.10 Moreover, state-wide data covering all dental insurers indicate inflation-adjusted reimbursement rates have declined in recent years in California.11 If more data were publicly available, a more thorough analysis could be conducted. In the meantime, our take on these preliminary data is that market power is being leveraged by insurers primarily to control costs rather than to increase premiums.

| DENTAL PLAN TYPE | COVERED LIVES IN 2016†† | ESTIMATED AVERAGE MONTHLY PREMIUM | |||

|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | Percentage Change (2014-2016) | ||

| Large Group DPPO‡‡ | 2,628,184 (69) | $43.18 | $42.56 | $41.44 | −4.05 |

| Large Group DHMO§ | 683,667 (18) | $14.64 | $14.40 | $14.00 | −4.34 |

| Small Group DPPO | 251,858 (7) | $53.45 | $50.55 | $49.37 | −7.64 |

| Individual DHMO | 142,040 (4) | $10.43 | $9.83 | $11.22 | 7.63 |

| Small Group DHMO | 76,771 (2) | $18.27 | $17.30 | $16.67 | −8.77 |

| Individual DPPO | 10,020 (< 1) | $32.46 | NA¶ | $52.84 | 62.82 |

Cost control measures, unquestionably, are a good thing for beneficiaries if such measures do not adversely affect access to dentists, quality of care, or benefit levels. Or, more formally, if the adverse effects are outweighed by savings in premiums. Here again we have another important area for further study. The evidence we are aware of—and it is limited—suggests that younger patients are more willing to trade provider choice for savings in premiums than older patients.12

Another way to examine the extent to which market power might affect premiums and provider payments is through medical loss ratio (MLR) data. The MLR measures the share of premium revenue that is spent on patient care. The ACA included a provision that MLRs for medical insurers must be at least either 80% or 85%, depending on the type of insurance. In other words, insurers must spend at least 80% or 85% of total premium revenue on patient care.13 In 2015, this MLR provision resulted in an average rebate paid by insurers to beneficiaries of $138 per family.14

The MLR provision under the ACA does not apply to dental insurers. However, in California, a law was put in place in 2014 to simply collect MLR data on dental insurers.15 We examined these data and found that among the 52 dental insurers in California, only 6 had MLR levels of at least 80%, including Delta Dental of California, the market share leader. (The dental MLR was calculated as total incurred claims/[total direct premium earned total federal and state taxes and fees to be excluded from premium]. The aggregate percentages at the insurer level were calculated by adding the total incurred claims, total direct premium earned, and total federal and state taxes and fees to be excluded from the premium at the insurer level and then using the aforementioned formulas. The amounts included for this analysis were noted as of March 31, 2016, in the dental MLR reports.) Eight carriers had MLR levels below 50%, meaning less than one-half of premium revenue was spent on patient care. These preliminary data suggest that expanding the ACA’s MLR provision to dental insurance could lead to premium reductions or enhanced outlays for dental care, both of which would presumably benefit consumers.

In big picture terms, our analysis of the California dental insurance market indicates a moderate level of concentration by FTC standards, with 1 dominant carrier. We have outlined some potential effects this level of market concentration might have on beneficiaries and providers, based on our interpretation of the data made available so far. Our analysis is based on 1 state and cannot be generalized to other markets. We urge other state agencies to make similar data publicly available. It is encouraging that several states, including Washington,16 Rhode Island,17Illinois,18 and Massachusetts,19, 20 are proactively pursuing measures to improve data transparency in the dental insurance market. At the national level, we urge organizations such as the National Association of Insurance Commissioners and the National Association of Dental Plans to make data transparency a priority when it comes to dental insurance. This is the only way researchers can study the implications of dental insurance market dynamics.